Mary Meeker’s presentation on 10 Questions internet executives should ask is clearly relevant for product strategist, marketers and executives in all technology companies, not just “internet companies”. This is another information rich piece from mobile to social.

Morgan Stanley

Market research is tough stuff and the availability of data online sometimes makes it tough to sift through all the data. Due to the massive amount of data out there, many marketers rely on analyst for synthesizing marketing data and providing the lion share of data used in research projects. While this approach can be helpful if you have a subscription, most of us need more context than high level numbers from an analyst firm to baseline our understanding of a market. It’s not that the analysts are off, they all have their own take on the market. Often analyst market definitions, approach to the market/research agenda and research methodologies make it very difficult to understand how it REALLY relates to your market.

To help improve your market intelligence there are 6 approaches you can leverage from online resources to round out your understanding of markets and help dig through the clutter of information available online.

1. Monitor Analyst Press Releases

Even if you have a subscription to an analyst firm, I still find the press release very interesting since it often provides the key metrics and conclusions you are to take away from a report or piece of research. Kinda like “Cliff Notes for Analysts”. Best of all this information doesn’t require subscription fees. For example, here is a release on mobiles impact on semiconductors from Gartner:

Gartner analysts stated that application-specific semiconductors for the phone market are experiencing intense competitive pressure, with revenue growing only about 13 percent in 2010. Smartphones continue to drive the mobile phone semiconductor market, representing 18 percent of units and 36 percent of overall 2010 mobile phone semiconductor revenue. These percentages increase to 41 percent of units and 64 percent of mobile phone semiconductor revenue by 2014 as entry-level smartphones trigger a second wave of growth in the market.

Once such a release it put online, it not only helps you with direct information, but can point you in other directions once the pundits start adding their take into the mix.

2. Search Online Presentation Repositories

There are numerous places to look (slideshare, scribd, event websites…) where you might be able to find relevant information for your market. To stay with mobile market information, there are over 700 slides from Morgan Stanley’s Mary Meeker alone: 2010 Internet Trends, iPad Game Changer and Mobile Internet Trends

These repositories are also another way to gain access to research from analyst as well. Just about every analyst firm has data available for you which can help you research you markets without a subscription. Some of the research is placed out there directly by the analyst firms, such as Frost & Sullivan’s slideshare presentations on healthcare, aerospace, energy and automotive, while others are posted by event organizers, customers or the analyst themselves.

2. Use Google Advanced Search to find hidden content

Not all content is easy to find or was put online for mass consumption. Maybe a presentation was for a customer conference, webinar or other specific purpose and is hosted directly on a web site rather being put in a repository. Google Advanced Search can help out with that by allowing you to specific file types online or even constrain to a given URL/website for returns. Here is an example of looking only for Microsoft Powerpoint Presentations:

You may need to goof around with search terms, but you can find some really insightful market data this way. You can also find cool competitive data that way as well. You wouldn’t believe what people put online in ppt and excel.

4. Dig into Public Filings and Financial Reports

One way to build an understanding of the state of your market is a bottom’s up approach to a market is to use public filings and information created for investors. It requires the most amount of legwork and probably some work in excel, but all good market research has some Excel and PowerPoint involved.

Basically you just take the information on your public competitors, your company and your private competitors to build up a market. Private competitors are tougher, but you should know the relative size of your other competitors which aren’t public and using the advance search on Google can unearth some interesting financial data if you don’t have a D&B account.

There are multiple ways to work public information, the purist would recommend pouring through 10-K’s since there are often interesting market dynamics which are cited for a given company’s performance in the narrative, but you just look at their website too. The investor and media relations part of public companies’ websites often house investor presentation slides, recordings of earnings calls and general financial release information as required.

Public information is just chock full of surprises and actionable information, even the glossy annual reports. By reviewing your competitor’s Annual Reports you can get additional market context.

What kind of information can you get? For example you can often get a nice geographic breakdown of revenues and other relevant information around services, software and other revenue splits, at least for your competitors. SAP provides an example set of such insights into mobile, what they see as growth segments and key geographies moving forward in their 2009 results presentation. If you get enough common slices of data from your competitors’ public filings and your own internal information, you can then start extrapolating it into the market at large.

5. Follow the Sources

Analyst blogs, competitor blogs, investor blogs and even your customer’s blogs may provide insightful information on your market and the trends as they blog about relevant trends and research they are seeing. While it might be obvious that blogs are important, there is one thing which it’s often overlooked by many – their sources.

Yup, it’s not necessarily the direct article that is most valuable, it might just be the sources which are linked which can help you the most. For example, Steve Keifer’s piece on Healthcare Information Exchanges provides interesting analysis, but links to the original source data which provides even more information.

Here are some other examples of interesting market insights from bloggers:

- Innovations, Trends and Sustainability Metrics in the Grocery

- Data Retention, Analytics and Cloud Trends

- Acquisition articles provide key trends and market driver information. eg. Alcatel-Lucent Buys OpenPlug Mobile App Developer

- Ray Wang’s software insider blog provides key adoption trends in everything from the cloud to scrm.

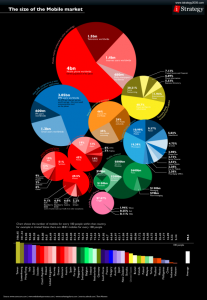

6. Let Pictures Provide the Meaning

The emergence of readily available Infographics onlie is just one of the coolest thing for marketers doing research. What’s interesting about infographics is that typically an infographic is a context based view of a market. Ok, it’s not new, but there are more and more of these being created now it seems and they provide fairly specific context typically.

The context provided in Infographics can help with understanding scale and provide clarity which is sometimes hard to do in the written word. For example, again in the mobile market, here is view into multiple dimensions of the market in a single infographic (scale, relevance, usage and geo-markets):

(you can click on it to blow it up)

Your Market Information is Out There

Net-Net, the data is out there for your markets. The challenge for all of us is how to do the leg work to apply it to your specific market, product and brand.

Analysts are just the start of the market research process for brand managers, product managers and market planners.