Image: A. Stiffler

From a product management and product launch perspective the last couple of weeks has provided a good deal of fun for many of us – Google+ launches and Netflix launches new pricing. Each with their own flavor of feedback from the market. The feedback and insight from the market for each of these activities have been the fodder of 100’s of blog posts and gazillions of tweets (guesstimate) and they both may represent a point in time where their target markets are changing.

Markets move and present opportunities and while significantly different markets, I belief both have put their best foot forward to address the changes in user preferences and technology adoption. Netflix is transitioning from a legacy market need with DVD‘s and Google looks to be taking advantage of gaps and preferences for users in the social space.

Clearly some segments of the social space are looking for something other than facebook and the buzz in the market from early adopters appears to show significant traction with Google’s launch into social. The negative feedback and general outrage in the market around Netflix strategic pricing decision is also a launch, but addressing an emerging trend from their user base and the market at large. A 60% price move is a big lift, so such a decision likely represents a strategic decision in response to research, transactional data and trends which indicate that streaming is now mass market and maybe DVD’s are on the way out.

10 Million Users, now what?

The momentum with Google+ is undeniable, but the type of content, the participants and available tools are pretty limited: technology focused content (the first week was all G+ content – thank goodness for netflix’s pricing launch!), the early folks from Twitter appear to be the first one to setup shop on G+ and no mobile option on the iphone.

Regardless of the content, network participants or availability of tools – 10 million users in 2 weeks is worth note without a doubt, but what will it do for social networking, users and how we use the internet? Which is something Facebook addresses today for it’s 750 million users. Olivier Blanchard addresses some of the questions in a recent post:

Will Google+ change the world or the internet? No. Google+ will not change the world. Or the internet…

Will Google+ kill Facebook? No one really knows. I suppose it could…

What about LinkedIn? If Facebook didn’t kill LinkedIn, chances are that Google+ won’t either…

So maybe the question is maybe why is 10 million users interesting? If I put the 10 million number into context – that’s less than 2% of Facebook‘s 750 million. So speed to 10 million might be an interesting metric, but what is the point where we all look to G+ over Facebook, Twitter or LinkedIn. Does Google+ need to kill anything to be successful? Is it enough to make Twitter boring? Or as the LinkedIn CEO posits, there isn’t room for another site, since free time is lacking for most.

No doubt there is some really interesting discussion going on online around Google+ and the Netflix pricing move. So I thought I might add my spin from a market perspective.

G+ is the Bomb!

There will always be fans for the newest thing, but with Scoble and Brogan taking pretty hard stances publically, it’s hard to ignore the noise. Here is a snippet from my Google+ stream which indicates some people are already betting on Google+, Chris Brogan appears to be “all-in” for Google+ over Facebook and while others are questioning if that’s a wise decision:

It is clearly to0 early to know what will really happen, ultimately the real answer will come out over time. Maybe Google+ is the next big platform, but at this point it is a niche as David Armano asserts, but the cottage industry for Google+ is already beginning with “How to Use SeminarsWorkshops” already popping up at $49 per attendee and irritating some in the industry.

If Google+ represents a change in the market, it means some people may not make the transition, just like some products and companies won’t make the transition successfully. Whether it’s the next big thing for social or a movement to a new mode for movies which mean something gets left behind – memories, references, case studies, investments and experience. When markets change, the participants can get a little huffy. Remember when Apple left the floppy disk out of a mac for the first time? That made people mad.

So what will make Google+ successful or users move to support Netflix in the next market move?

Features? Community? Content? Catalog?

In both the Netflix launch and Google+’s, users have a decision to make. Stay where they are (Use current tools or pay more for DVD’s), make a change (Augment social with G+ or go to a new provider for Movies) or make a radical change (Abandon previous social modes or DVD’s). While at different points in market maturity, both of the launches represent choices and change, which is stressful for the community of users/customers.

So is there a magic bullet to make people move? Depends on who you are and what value you have invested in the previous solution (FB/Twitter, DVD’s…), but there has been a good deal of talk around Google+ and their really nifty features.

Google has change social much in the same way Gmail used a different metaphor, Google+ is no different with circles (this takes a diagram to really understand), real-time update of the stream (this takes time to get used to), sparks (not sure I really get it or it’s just a bad implementation) and easy access to all of the capabilities we already enjoy from Google, but is that enough?

While the content portability, privacy and ownership at Facebook is an issue for many is this enough to drive change? Does the value offered around community and content in respect to identity and openness at Google+ help drive commerce and collaboration as Facebook has already established for their stakeholders in the market.

It’s not the Numbers, it is the Value for the Users

So where is this post going? Well, I think the real question is when will Google+ have enough value for a people to abandon their existing investments/endowments in Facebook and move to Google+. Investments in time, content, relationships… Has streaming crossed a threshold where we as owners of 100’s of DVD’s are will to start investing in the new medium for our movie catalog?

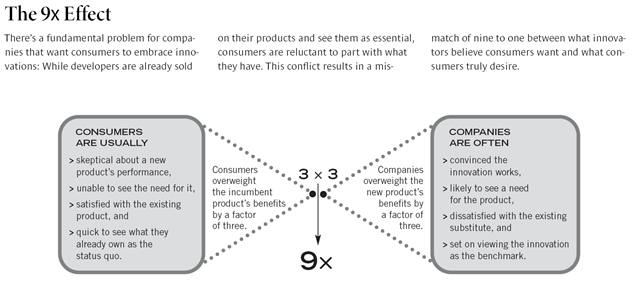

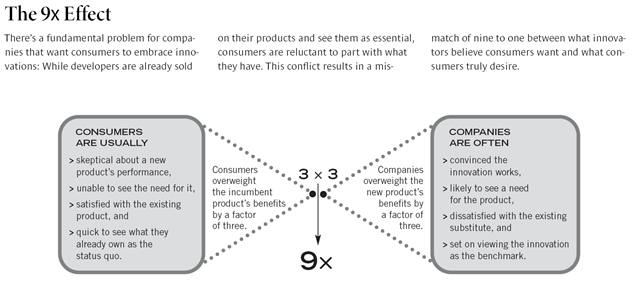

For Google+ to achieve a “kill Facebook/some existing thing goal”, it needs to break through the 9X effect for perceived value delivery. The 9X effect is a concept from John Grouville’s paper, Eager Sellers and Stony Buyers, which posits innovation with significantly better value may not actually mean success in many markets. Success comes in many segments when a previous solution/endowment is abandoned for a new solution.

Below is a graphic which outlines the challenge ahead for Google+ and perhaps a driver in the pricing increase on the legacy endowment of DVD’s at Netflix.

FWIW: The 9X effect relates to displacing any platform/investment in technology, not just Facebook or DVD’s:

Essentially just because it’s different, better and seen by some folks, like early adopters it doesn’t mean success. Tivo is an example of a business which delivered an innovative product, the incremental value over DVR’s from our cable providers is proving to be a central challenge for Tivo today.

Tivo – Great product, early inertia and a business model which is currently struggling to work, much of which is rooted in the 9x effect conundrum. With the catch up of cable DVR’s, existing DVD collections and on demand options most users don’t see a 9X+ lift with Tivo, even early adopters have dropped of the subscriptions, like me.

Markets are People

Businesses often opportunistically try to leverage market change to wedge in new offerings and approaches for folks in markets. The challenge is that each person in the market has different experiences, successes/failures, investments and world views which impact how they view market changes. I mean my dad still is mad about 8 track’s going away and he’s 73. So when understanding the 9X effect, Andrew Macaffee set’s forth 3 considerations as it relates to how given users look at their options around technology adoption/usage:

- We make relative evaluations, not absolute ones. When I’m at a poker table deciding whether to call a bet, I don’t think of what my total net worth will be if I win the hand vs. if I lose it. Instead, I think in relative terms — whether I’ll be ‘up’ or ‘down.’

- Our reference point is the status quo. My poker table comparisons are made with respect to where I am at that point in time. “If I win this hand I’ll be up $40; if I lose it I’ll be down $10 compared to my current bankroll.” It’s only at the end of the night that my horizon broadens enough to see if I’m up or down for the whole game.

- We are loss averse. A $50 loss looms larger than a $50 gain. Loss aversion is virtually universal across people and contexts, and is not much affected by how much wealth one already has. Ample research has demonstrated that people find that a prospective loss of $x is about two to three times as painful as a prospective gain of $x is pleasurable.

These three drivers are significant barriers which innovators and marketers need to overcome to call something a success. The relative reality of value just may have caused the negative feedback on the new pricing launch from Netflix. While the outrage was swift and loud online, the real question is how many of us are really willing to make a move? The move to another provider? The move to the new package for 60% more? A move to streaming only?

As a avid user of social media, I haven’t really even thought what it will take to displace Facebook, as a user I actually am pretty tethered due to friends and family I’m connected to and this is the only place they really invest online. So I’m not sure it’s what would make me move that matters, it is more about delivering enough value to make my network move. Same thing with my Twitter usage, so that’s a pretty big bar, but I might make G+ serve a specific segment of my life.

When is the mass market of users and the businesses which use Facebook willing to make a move or to even adopt an additional platform. While the early adopter buzz is interesting, it doesn’t represent the typical user in the market and is almost meaningless. For right now it is more than likely shiny object syndrome more than anything and may best be a niche platform.

I consider myself a fairly early adopter and usually somewhat susceptible to shiny object syndrome, because what if the next one is it. To that end, I’ve gone to and started using the platform du jour over the years (Friendfeed, posterous, tumblr, Quora), much like I’m trying Google+, but none of them have really taken off or at least they haven’t been integrated in my life as Twitter and Facebook are. This early adopter mode which I often find myself in was probably one of the reason I had a Tivo years before DVR’s where common and a several streaming accounts early on (Amazon, Netflix, Hulu..).

Escape Velocity is more than Buzz, it’s a Business Model and Strategy

While I don’t have a crystal ball, I do know that time and value delivery are the key variables which will determine if a product will be a success. Netflix’s investment in streaming has been significant over time – infrastructure, catalog of movies and strategic partnerships with content providers has changed the market for many who previously didn’t even think streaming was an option. For many, streaming was a value add around the DVD offering – is it possible both Netflix and Google are both looking a situation where a 9X effect will dictate a move for their business and the products they offer to market.

Maybe Google+ will be niche as Armano asserts and could do this very successfully by many metrics or it could be the next Platform we all use and engage in as Brogan believes it may be. The current global facebook endowment is pretty big:

- More than 750 million active users

- 50% of our active users log on to Facebook in any given day

- Average user has 130 friends

- People spend over 700 billion minutes per month on Facebook

- More than 30 billion pieces of content shared each month.

Add to the users investments, there are businesses as well investing in Facebook – a cottage industry of app developers and a global spin machine of marketing consultants who are focused on FB it’s a really big endowment, but not unlike the investment many of us have in DVD’s.

9X Effect: Mileage and Strategies Will Vary

The main difference between the challenge both Google+ and Netflix have which each of their markets is the adoption of users, while Google is hoping that social provides an opportunity to displace many people and businesses social investment and Netflix just might be hoping that DVD’s are done or near done.

Maybe the price increase is based on Netflix looking at their market and believes streaming has finally achieved enough value that DVD’s are no longer relevant for a majority of the market. And if you want to be part of the laggard DVD market, you can pay more – makes sense to me.

Strategically, Netflix’s decision may have changed the market with the a $6 price increase. This decision may actually accelerate the abandonment DVD’s endowment in the market. When I first got notified on the new pricing, I looked at the $6 dollars not a price increase, but a continued investment in my existing DVD endowment. For me, I’ve chosen that now is the time move on from DVD’s, not Netflix because the streaming fees are still worth it from my perspective.

So where is the point in time that some social platform displaces our Facebook investment? I suspect it is some time off and requires a significant amount of value for all constituents on the platform – users, advertisers, app developers and marketers.

It may well be that Google+ never will never successfully address the 9X effect for displacing Facebook/other social platform, but does it have to be successful? Does Netflix have to kill the DVD to be successful?