So a concept which is seldom put into most models and business plans is NPV. NPV is the concept/construct for evaluating long term projects and investments. Every company does it slightly differently in respect to the defining the acceptable discounting values to use in a NPV analysis. Why is [tag]NPV[/tag] beneficial?

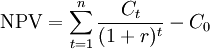

It provided a barometer for a given investment which then allows you to overlay the opportunity costs to provide a holistic view of an investment. Here is the general formula (wiki) and overview from [tag]excel[/tag]:

Where

- t – the time of the cash flow

- n – the total time of the project

- r – the discount rate

- Ct – the net cash flow (the amount of cash) at time t.

- C0 – the capital outlay at the beginning of the investment time ( t = 0 )

But [tag]microsoft[/tag] has made it simple for us:

NPV(rate,value1,value2, …)

Rate is the rate of discount over the length of one period.

Value1, value2, … are 1 to 29 arguments representing the payments and income.

Value1, value2, … must be equally spaced in time and occur at the end of each period.

NPV uses the order of value1, value2, … to interpret the order of cash flows. Be sure to enter your payment and income values in the correct sequence.

Arguments that are numbers, empty cells, logical values, or text representations of numbers are counted; arguments that are error values or text that cannot be translated into numbers are ignored.

If an argument is an array or reference, only numbers in that array or reference are counted. Empty cells, logical values, text, or error values in the array or reference are ignored.

RemarksThe NPV investment begins one period before the date of the value1 cash flow and ends with the last cash flow in the list. The NPV calculation is based on future cash flows. If your first cash flow occurs at the beginning of the first period, the first value must be added to the NPV result, not included in the values arguments.

Value of NPV from Wikipedia

What NPV tells

NPV is an indicator of how much value an investment or project adds to the value of the firm. With a particular project, if Ct is a positive value, the project is in the status of discounted cash inflow in the time of t. If Ct is a negative value, the project is in the status of discounted cash outflow in the time of t. Appropriately risked projects with a positive NPV may be accepted. This does not necessarily mean that they should be undertaken since NPV at the cost of capital may not account for opportunity cost, i.e. comparison with other available investments. In [tag]financial theory[/tag], if there is a choice between two mutually exclusive alternatives, the one yielding the higher NPV should be selected.

I’m not sure I agree with the general construct of decision making, as sometimes projects are just required and other project valuation methodologies from [tag]Net Present Value[/tag] analysis might be best, like the general payback period approach or cost-benefit – cost benefit is great for internal projects which aren’t revenue centric.

Multiple views of any project may help better understand the shape of the project and if each produce favorable metrics then even better.

No Comments