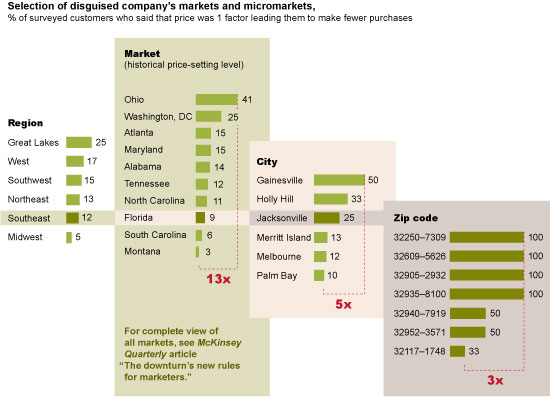

Typically when I look at McKinsey‘s reports I take away some meaningful data which I file away in my head for future use, but in a recent Chart Focus piece I had more questions than kernels of knowledge to use. I was really caught by the interesting assertions and regionalism based approach from David Court’s piece on the The Downturn’s New Rules for Marketing, but as I looked at the chart I got just a little confused. Below is the teaser content which encouraged me to read on:

In previous recessions, many marketers doubled down on large, historically profitable customers, geographies, and market segments—an approach that may now be ineffective because economic woes are affecting consumers and markets in unexpected and very specific ways. Marketers should therefore toss out their historical expectations and look for emerging pockets of profitability.

In all fairness the piece that the chart comes from was originally published in 2008, so I suspect the backing data set is just a little stale, but my concerns with the hierarchical categorization still remain. Even though the piece is a little aged, I’m pretty sure the concepts of regions, states and cities were fairly well defined by then. Below is the graphic which indicates that Atlanta and Washington D.C. have achieved the functional equivalency of statehood for market analysis, which is just a little off from my perspective.

Now admittedly this just could be a bad graphic (that’s actually probably it), but it begs the several questions at least for marketers:

- How should a marketer define a region?

- How can a state have the same market qualities of a city?

- What is the median income of the different zips analyzed in Jacksonville?

- What are the deltas in Housing Values in the Jacksonville zip codes presented?

- People allocate meaningful marketing spend in Montana which can be analyzed?

- Would it have been more valid to only look at incomes, unemployment rates and zip codes?

- Can any data set from 2008 really be used 12 month’s later when it comes to B2C?

- Recession? What recession?

While the full piece asserts the probable impact of unemployment, the housing sector changes and other key indicators which would impact consumerism, it doesn’t provide any additional data sets of note except one manufacturer’s anecdotal experience in their customer base customer base, which means the piece mixes B2B and B2C for some unknown reason. The main thing I take away from the piece, is that old models are broken.

Observation: Maybe, just maybe, it’s only about micro-markets now.

Potential Articles of Interest

- Improve throughput, cut your customers in half! (business901.com)

- Ideas to Income: An introduction to marketing (slideshare.net)

- The Simplest Secret To Business Growth (ducttapemarketing.com)

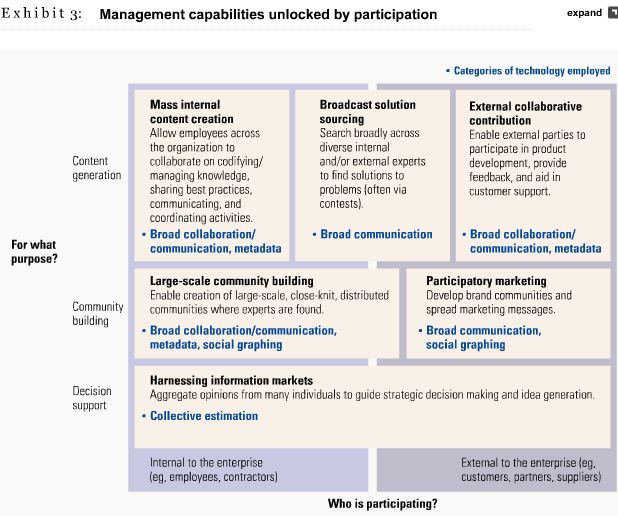

- Global Survey Shows Benefits of Web 2.0 (revenews.com)